Are Roadside Assistance Plans Worth It? Your Ultimate Guide

We breakdown the toughest of decisions relating to your car.

Imagine your car quits working on a lonely road. Maybe it is a flat tire on the way to an important meeting. Or your battery dies on a cold morning, leaving you stuck. Running out of gas miles from anywhere can cause pure panic. These common roadside problems bring a lot of worry and inconvenience. They can turn a simple trip into a major headache for any driver.

Roadside assistance plans promise a solution. They offer help when your vehicle leaves you stranded, and you feel most helpless. These plans typically provide services like towing, jump-starts, and tire changes. They aim to get you back on the road fast or safely to a repair shop.

This raises a big question for many car owners. Are these plans truly worth their regular cost? Does the peace of mind outweigh the annual fee? Let's explore the benefits, drawbacks, and key factors to consider.

Understanding What Roadside Assistance Covers

Common Services Provided

Roadside assistance plans offer many services. These aim to help when your car stops working. Knowing what they include is key.

- Towing: If your car breaks down completely, towing service moves it. This can be a flatbed tow for all-wheel-drive vehicles or a wheel-lift for others. Plans often limit the towing distance, like 5 to 200 miles. You might pay extra for longer hauls.

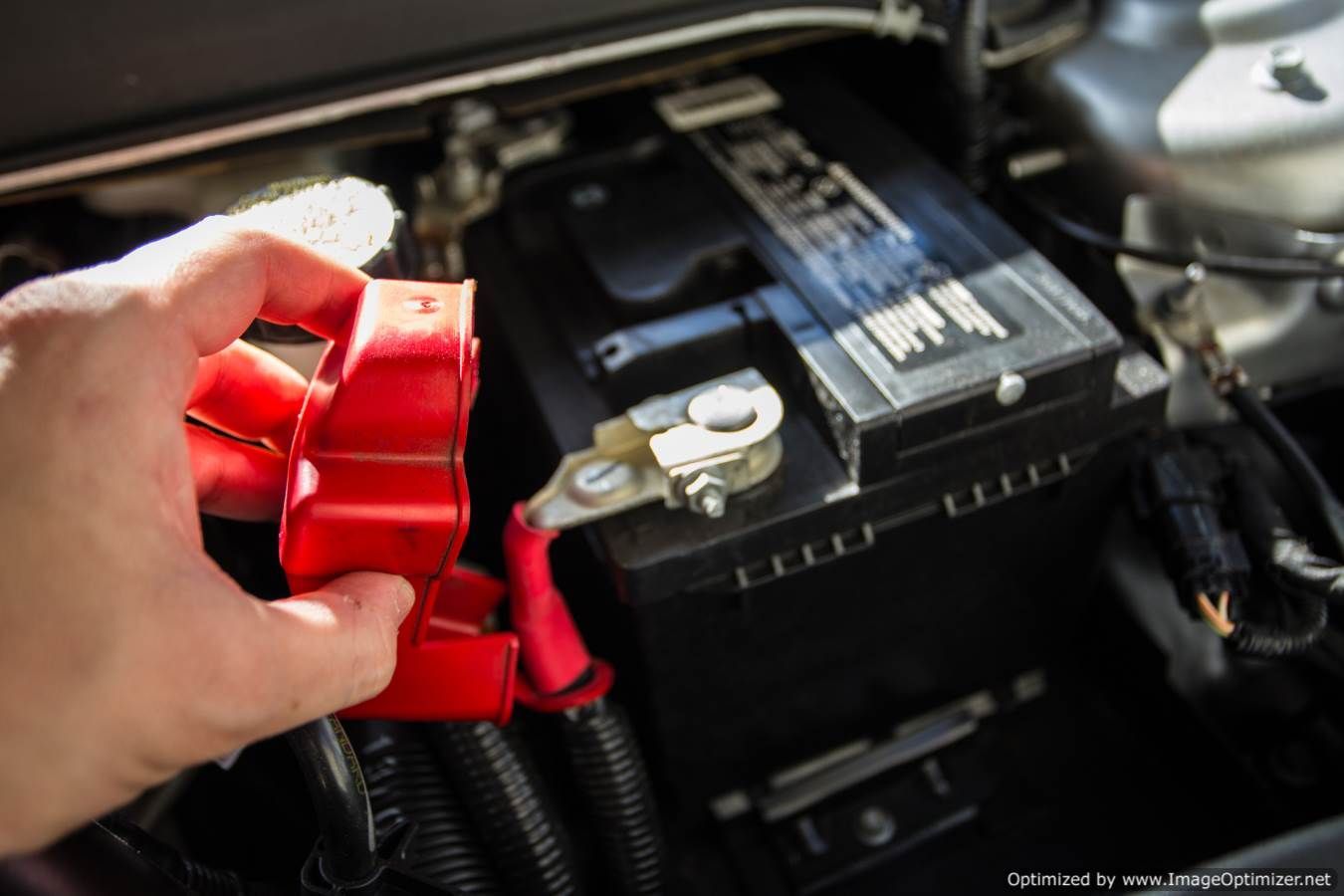

- Battery Jump-Starts: Dead car batteries happen often, especially in extreme weather. This service sends help to give your battery a quick boost. It gets your car started so you can drive it to a shop or home.

- Flat Tire Changes: A flat tire can ruin your day. Assistance plans include changing a flat with your vehicle's spare tire. They do not usually fix the damaged tire itself.

- Fuel Delivery: Running out of gas is a common mistake. Roadside assistance can bring a small amount of fuel to you. This is just enough to reach the nearest gas station.

- Lockout Services: Locking your keys inside the car is frustrating. This service sends a technician to help you get back into your vehicle. They aim to do this without damage to your doors or windows.

- Winching/Extrication: If your car gets stuck in mud, snow, sand, or a ditch, winching helps. This service pulls your vehicle back onto solid ground. It's especially helpful in bad weather or off-road situations.

Coverage Variations and Limitations

Not all roadside assistance plans are the same. They often have different rules. It is smart to read the fine print.

- Membership Tiers: Many providers offer different plan levels. A basic plan may cover just jump-starts and short tows. Premium plans could include longer towing distances or more service calls per year.

- Distance Limits: Towing distance is a major point. Some plans offer 5 miles, while others cover 100 miles or more. Going beyond this limit usually means you pay extra per mile.

- Number of Service Calls: Plans often limit how many times you can use their help each year. This might be three or four calls per membership period. More calls could mean extra fees.

- Vehicle Eligibility: Some plans have rules about what cars they cover. Very old cars, heavy-duty trucks, or modified vehicles might not qualify. Always check if your car is included.

- Geographic Restrictions: Most plans work throughout the United States and Canada. Still, some might have limits. Verify coverage if you plan to travel outside your usual areas.

The Financial Equation: Cost vs. Benefit

Typical Plan Costs

When thinking about roadside assistance, its cost is a big factor. How much do these plans usually charge? Many main providers like AMA or your car insurance company offer them.

- Annual Premiums: Standalone roadside assistance plans typically cost between $50 and $150 per year. The price depends on the level of coverage you choose. Basic plans are cheaper, while premium ones with more benefits cost more.

- Pay-Per-Use Costs: Without a plan, you pay for each service as you need it. A jump-start could cost you $50 to $150 from a local service. Towing can range from $75 for a short pull to $250 or more for longer distances. A tire change might be $50 to $150. These costs can add up quickly.

Potential Savings and Hidden Costs

Having a plan can save you money. It also provides peace of mind. But be aware of any extra charges.

- Cost of an Emergency: A single breakdown without a plan can be very expensive. A tow alone might cost over $100. Add labor costs, and you could be looking at hundreds of dollars. Lost wages from a delayed workday also count. A plan prevents these sudden, large bills.

- Insurance Deductibles: If you use your car insurance for a breakdown, it might count as a claim. This could raise your future insurance rates. A roadside assistance plan keeps these minor issues off your insurance record. It helps you avoid paying your deductible.

- Membership Exclusions: Be careful of what plans do not cover. For example, some might not pay for parts or major repairs. Some may limit towing if your car broke down due to an accident, not a mechanical issue. These can lead to unexpected out-of-pocket costs.

- Value of Convenience: Beyond money, there is the value of ease. With a plan, you make one phone call. Help arrives. You avoid searching for a tow truck in a stressful moment. You do not have to haggle over prices. This saves time and a lot of worry.

Who Benefits Most from Roadside Assistance?

Some drivers find roadside assistance especially helpful. Consider if you fit one of these groups.

New Drivers and Less Experienced Mechanics

New drivers often lack experience. They might not know how to handle car problems. Roadside assistance can be a safety net.

- Lack of Mechanical Knowledge: Many new drivers do not know how to change a tire. They might not understand why a car won't start. A plan means a professional will handle the problem for them. This avoids unsafe attempts at DIY fixes.

- Unfamiliarity with Service Providers: If you are new to an area, you might not know any trusted repair shops or tow companies. A roadside assistance plan connects you to a network of reliable service providers. You do not have to search for one on your own.

- Confidence Boost: Knowing help is just a phone call away gives new drivers more confidence. This peace of mind is invaluable, especially when driving alone or at night. It reduces anxiety about unexpected car trouble.

Frequent Travelers and Long-Distance Commuters

Spending a lot of time on the road increases your risk. Roadside assistance becomes more important for frequent drivers.

- Increased Exposure to Risk: The more you drive, the higher the chance of a breakdown. Long commutes or road trips mean more wear and tear on your vehicle. A plan covers you for those added miles.

- Remote Location Risks: Breaking down in a rural or remote area can be scary. Help is often far away. Roadside assistance providers have a wider network. They can usually reach you even in less populated spots.

- Time Sensitivity: If you are on a tight schedule, delays are costly. Roadside assistance aims for quick response times. This can save you from missing important meetings or events due to car trouble.

Owners of Older Vehicles

Older cars often need more attention. They are also more likely to have mechanical issues. A roadside plan can offer protection.

- Higher Likelihood of Mechanical Issues: Parts wear out on older cars. Batteries die more often. These vehicles are simply more prone to unexpected breakdowns. A plan can cover these more frequent incidents.

- Predicting Maintenance Needs: While a plan doesn't fix your car, it helps with the impact of sudden failures. You might expect an older car to need repairs. A plan handles the immediate problem, like a tow, without a big surprise cost.

- Cost-Effectiveness Comparison: The annual cost of a roadside assistance plan is usually small compared to a single major repair bill. For an older vehicle, this plan can be a wise financial choice. It protects your budget from sudden towing or jump-start expenses.

Alternatives to Traditional Roadside Assistance Plans

Not every driver needs a separate roadside assistance plan. Other options might fit your needs better.

Built-in Vehicle Manufacturer Programs

Many new cars come with roadside help. This is often part of your warranty. It's a perk you already own.

- Coverage Details: Most new vehicles include roadside assistance for a set period. This might be 3 years or 36,000 miles. It covers common issues like towing, jump-starts, and lockouts. Check your car's manual or dealer for exact details.

- Limitations: These programs are usually time-limited. Once your warranty ends, so does the roadside coverage. They also have mileage caps. You must buy a new plan when it expires.

- When to Consider: If you have a new car, check its existing warranty. You might not need another plan for a few years. It's a benefit you've already paid for.

Auto Insurance Policy Add-ons

You might be able to add roadside help to your car insurance. This can be a simple way to get coverage.

- Integration Benefits: Adding roadside assistance to your existing auto insurance policy is convenient. You have one bill and one number to call for all car-related needs. It simplifies your coverage.

- Cost Comparison: This add-on is often cheaper than a standalone plan. It might cost as little as $5 to $15 per year. Compare its coverage and cost against dedicated roadside clubs.

- Potential for Premium Increases: While cheap, using your insurance's roadside benefit often can sometimes lead to a small premium increase at renewal. Check with your insurance provider to understand their policy on claims and rates.

Credit Card Benefits

Certain credit cards offer roadside assistance as a hidden perk. You might already have this coverage.

- Specific Card Perks: Premium credit cards, especially travel or auto-focused ones, often include emergency roadside dispatch. They usually do not pay for the service but arrange it for you. You pay for the service directly.

- Coverage Limits and Activation: These benefits vary greatly by card. Some might offer a limited number of free services. Others only arrange the service, leaving you to pay the bill. You usually need to call a specific number on the back of your card to activate it.

- Best Use Cases: This option is good for drivers who rarely need roadside help. It is also good for those who carry a card that offers it for free. For frequent needs, a dedicated plan might be better value.

Everyday Low Price Service Providers

Certian providers such as us 30 Dollar Roadside provide services with a every day low pricing model. We make our money from volume sales meaning we can offer prices as low as $30 dollars. Larger roadside assistance companies such as AMA have much bigger fleets of trucks with a lot more labourers than us. However, companies as large as AMA are heavily overleveraged meaning they take a lot of loans and have a great deal of liabilities while trying to create value for their shareholders. Overleveraged service providers are FORCED to charge customers prices that are off the charts. We at 30 Dollar Roadside have a small efficient footprint, we don't own any unnecessary real estate, we only own vehicles that are efficiently used nothing sits and nothing is ever wasted.

Look, we will put it like this when you pay for a subscription for a roadside assistance program, the math has already been done and the only reason you are going to pay 150-200 for your membership is because they anticipate you rarely using it. Trust us at 30 Dollar Roadside to be give you the best possible price and the best experience when you need it most. Roadside assistance shouldn't function like your old Netflix subscription where you just pay for it monthly and barely use it.

Making an Informed Decision: Actionable Tips

Deciding if a roadside assistance plan is right for you involves a few steps. Think about your unique situation.

Assess Your Driving Habits and Vehicle

Your daily driving and vehicle type play a big role. Honest self-assessment is key.

- Analyze Mileage: How many miles do you drive each year? High mileage means more time on the road and a greater chance of a breakdown. Someone driving 20,000 miles annually has higher risk than someone driving 5,000.

- Analyze Driving Locations: Do you mostly drive in busy city areas with easy access to help? Or do you travel often on remote highways where service is scarce? Your location affects how vital a plan might be.

- Vehicle Reliability: What is your car's make, model, and age? Research common issues for your specific vehicle. Older cars or less reliable models might benefit more from a plan.

Research and Compare Providers

Do your homework before you pick a plan. Not all providers are equal.

- Read Reviews: Look up customer reviews and satisfaction ratings for different roadside assistance companies. Check out forums or consumer reports. This tells you about their service quality and response times.

- Compare Coverage: Get quotes from several providers. Carefully compare what each plan covers. Pay close attention to towing distance limits, number of service calls, and exclusions. A cheaper plan might offer much less.

- Check for Discounts: Ask about ways to save money. Some providers offer discounts for multiple vehicles on one plan. Good driving records or group memberships (like through your job) might also lower the cost.

Consider Your Risk Tolerance and Budget

How much risk are you comfortable taking? Your financial state also matters.

- Peace of Mind Value: How much is it worth to you not to worry about breakdowns? For some, the comfort of knowing help is always available is priceless. For others, saving the annual fee is more important.

- Financial Preparedness: Can you easily afford an unexpected $200-$500 towing or repair bill right now? If not, a plan acts as an affordable safety net. It prevents a sudden financial burden.

- Budget Allocation: Look at your overall household budget. Can you comfortably fit the annual cost of a roadside assistance plan? Weigh this against the potential high cost of a breakdown without one.

Conclusion: Your Roadside Safety Net

Deciding if roadside assistance plans are worth it comes down to a few factors. If you are looking for to pay monthly and barely use your benefits more than couple times a year, then a company like 30 Dollar Roadside is perfect for you. Third party providers are structured much differently than your average roadside assistance provider. At 30 Dollar Roadside we are mechanics first. We understand your vehicle better than a tow truck driver and in this massive pyramid scheme you lose out on the personal touch a mechanic can give you when it comes to your vehicle.

However, in some situations having AMA can be a good thing such as if you own problematic vehicles such as VW, Audi, BMW, that are prone to breaking down and you see that you will be able to use the roadside assistance plan completely then a plan might be for you. Most commuters no not need such a plan and the average person at most will utilize a roadside assistance service not more than 1-2 times a year. Give us a call today and stop overpaying for roadside assistance!